Tax Benefits for New Immigrants & Returning Residents in Israel -2025 Update

The State of Israel offers various tax benefits to new immigrants (“Olim Hadashim “) and returning residents to ease their integration and provide incentives for their return. Based on the latest available information, this article outlines the main benefits as of 2025.

Tax Exemption and Reporting Relief on Foreign Income

New immigrants (Olim Hadashim) and “long-time returning residents” are entitled to a full exemption from tax and reporting obligations in Israel on income originating outside Israel for ten years from their date of immigration or return. The exemption applies to various types of income, including:

- Passive Income: Such as dividends, interest, and rental income.

- Capital Gains: Such as profits from the sale of assets abroad.

It is important to note that this exemption does not apply to income derived from Israeli sources.

Income Tax Credit Points

New immigrants (Olim Hadashim) are eligible for income tax credit points, reducing the tax payable amount. The duration of eligibility varies according to the date of immigration:

- Immigrants who arrived before January 1, 2022: Eligible for tax credit points for 42 months (3.5 years).

- Immigrants who arrived on or after January 1, 2022: Eligible for tax credit points for 54 months (4.5 years).

Breakdown of tax credit points:

- First 12 months: 1 tax credit point per month.

- Next 18 months: 3 tax credit points per month.

- Next 12 months: 2 tax credit points per month.

- Final 12 months (only for immigrants from 2022 onwards): 1 monthly tax credit point.

Additionally, there are options to defer the eligibility period in some instances, such as military service, academic studies, or prolonged stays abroad.

Tax Exemption on Foreign Pensions and Annuities

New immigrants (Olim Hadashim) and long-time returning residents are entitled to a tax exemption on pensions and annuities received from abroad for ten years from their date of immigration or return. The exemption applies to retirement pensions, disability pensions, survivor benefits, and other pension-related income.

Year of Acclimatization

New immigrants (Olim Hadashim) and returning residents may choose to have their first year in Israel considered an acclimatization year, during which they are not regarded as Israeli residents for tax purposes. During this year, they remain eligible for benefits provided by the Ministry of “Aliyah” and Integration but are not liable for tax on foreign-sourced income. An application for an acclimatization year must be submitted within 90 days of obtaining resident status.

Tax Exemption on Interest from Foreign Currency Investments

New immigrants (Olim Hadashim) and returning residents are entitled to an exemption from tax on interest income derived from foreign currency investments, provided the investment was made for the first time after their immigration or return to Israel. The exemption applies for ten years from the date of immigration or return.

Real Estate Tax Benefits

New immigrants (Olim Hadashim) are entitled to reduced purchase tax rates when buying a residential property in Israel, subject to specific conditions. The benefit only applies to purchasing a single property, and applicants must meet the legal requirements.

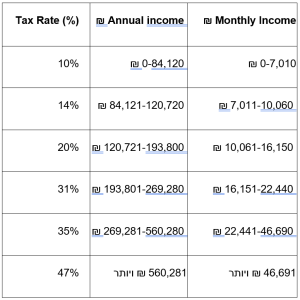

Income Tax Brackets for 2025

Below are the updated income tax brackets for salaried income as of January 2025:

Additional Surtax

In addition to the standard tax brackets, an additional surtax (“high-income tax”) applies to annual income exceeding a specific threshold. As of 2025, a 3% surtax is imposed on taxable income exceeding ₪698,280 per year (approximately ₪58,190 per month). Additionally, a 2% surtax applies to capital gains above this threshold.

Additional Support

The Ministry of Aliyah and Integration provides further support for new immigrants (Olim Hadashim) and returning residents, including:

- Housing Assistance: Rental subsidies or grants for purchasing a home.

- Professional Training: Courses and vocational training to facilitate integration into the labor market.

- Advisory and Support Services: Personal consulting and guidance in various areas.

In conclusion, Israel offers a wide range of tax benefits and support services to new immigrants (Olim Hadashim) and returning residents to ease their integration and encourage their return. It is advisable to consult with tax professionals and relevant authorities to maximize the available benefits.

Chairman of AUREN Israel